Technology

Accessing and Reading your 1098-T Form

Last modified 11/20/2024

Students may access their Form 1098-T Tuition Statement via the My.IllinoisState.edu web portal.

Before You Begin

As a student, you may qualify for an education credit on Tax Forms 1040 or 1040A for tuition-related expenses. If so, you will need Form 1098-T.

An explanation of the 1098-T form is provided below. Additionally, information about Form 1098-T may be viewed in the FAQ section of the Student Accounts website at https://studentaccounts.illinoisstate.edu/tax-credit/.

View Your Form 1098-T

To view your Form 1098-T in the My.IllinoisState.edu web portal, please use the following steps:

- Log in to My.IllinoisState.edu via Central Login.

- For more information about Central Login at ISU, please refer to: Central Login

- Click the Finances tab at the top of the page.

- Under the heading Student Accounts, click 1098-T Tax Form.

You will now be able to view your 1098-T tax form online.

Form 1098-T Explained

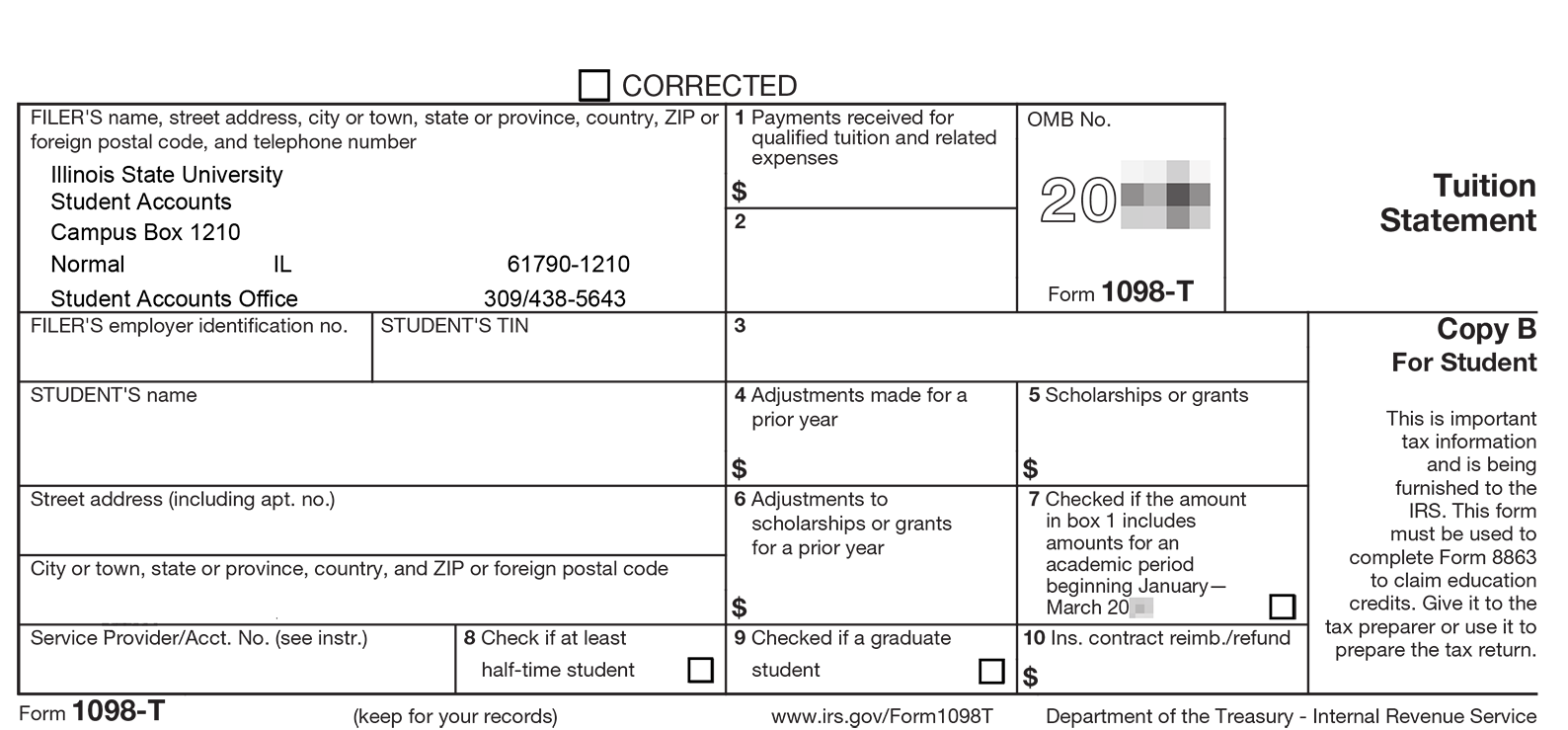

A sample 1098-T form is shown below for your reference.

Box 1: Payments received for qualified tuition and related expenses

Payments received from any source for qualified tuition and related expenses less any related reimbursements or refunds (reported in tax year 2018 and forward)

Box 2: Amounts billed for qualified tuition and related expenses

Amount billed during the calendar year for qualified tuition and related expenses less health service fees and student insurance charges (reported in tax year 2017 and prior).

Box 3: If this box is checked, your educational institution has changed its reporting method for 20XX

This box was checked for tax year 2018 only to reflect the change in reporting method from box 2 to box 1.

Box 4: Adjustments made for a prior year

Shows any adjustment made for a prior year for qualified tuition and related expenses that were reported in Box 2 on a prior-year Form 1098-T. This amount may reduce any allowable education credit you may claim for the prior year. See Form 8863 or Pub. 970 for more information. The most common example of this would be if you had been billed for Spring tuition in December, then subsequently dropped the class in January.

Box 5: Scholarships or grants

Shows the total of all scholarships or grants administered and processed by the eligible educational institution for the calendar year. The amount of scholarships or grants for the calendar year may reduce the amount of any allowable tuition and fees deduction, or education credit, you may claim for the year.

Box 6: Adjustments to scholarships or grants for a prior year

Shows adjustments to scholarships or grants for a prior year. This amount may affect the amount of any allowable tuition and fees deduction, or education credit, you may claim for the prior year. This would be a scholarship/grant reported in Box 5 in a prior tax year that has been reduced this tax year. The Financial Aid Office (Phone # 309-438-2231) can provide information on the reason for the reduction in aid. See Pub. 970 for how to report these amounts.

Box 7: Checked if the amount in Box 1 or 2 includes amounts for an academic period beginning January - March 20XX

Shows whether the amount in Box 1 or 2 of the form includes amounts for an academic period beginning January-March of the next tax year. The Box will be checked if Box 2 includes Spring charges for the next tax year.

Box 8: Check if at least half-time student

Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at the reporting institution. This Box will be checked if you are carrying at least a half-time course load.

Box 9: Checked if a graduate student

Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level education credential. This will be checked if you are a Graduate student.

Box 10: Ins. contract reimb./refund

Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. The amount of reimbursements or refunds for the calendar year may reduce the amount of any allowable tuition and fees deduction, or education credit, you may claim for the year. This amount will be zero.

How to Get Help

For financial aid assistance, please contact the Financial Aid Office at:

- Phone: (309) 438-2231

- Email: FinancialAid@IllinoisState.edu.

Technical assistance is available through the Illinois State University Technology Support Center at:

- Phone: (309) 438-4357

- Email: SupportCenter@IllinoisState.edu

- Submit a Request via Web Form: Help.IllinoisState.edu/get-it-help

- Live Chat: Help.IllinoisState.edu/get-it-help

See Also:

Feedback

To suggest an update to this article, ISU students, faculty, and staff should submit an Update Knowledge/Help Article request and all others should use the Get IT Help form.